Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you will been keeping an eye on the OTC markets you may have come across LIFW stock the ticker for MSP Recovery Inc. (also operating as LifeWallet). This company has gained attention for its disruptive approach to healthcare data and claims recovery a niche but rapidly growing sector.

In this article we will break down everything you need to know about LIFW stock its financial background business model risks and future outlook.

Whether you are a retail investor or just researching high risk high reward stocks this guide is tailored to give you a unique and detailed understanding.

LIFW is the stock symbol for MSP Recovery, Inc. a company operating under the brand name LifeWallet. The company specialises in recovering wrongly paid healthcare claims using advanced data analytics and AI.

Their mission is to fix inefficiencies in the U.S. healthcare reimbursement system an industry worth billions.

LifeWallet went public via SPAC merger and currently trades under LIFW on the NASDAQ, but it often behaves like a penny stock due to its low price and high volatility.

MSP Recovery focuses on using legal means to reclaim improperly paid Medicare and Medicaid claims often working with law firms healthcare providers and insurance companies.

MSP Recovery is not your average healthcare company. It uses litigation as a revenue model leveraging data to identify payment errors and file claims against the responsible parties.

The U.S. healthcare system loses billions annually due to billing errors. LIFW targets these inefficiencies and if their model scales the upside could be massive.

The company claims to use AI and machine learning for advanced data analysis allowing them to uncover overlooked reimbursement opportunities.

Like any penny stock LIFW carries significant risks. Some of the major red flags include:

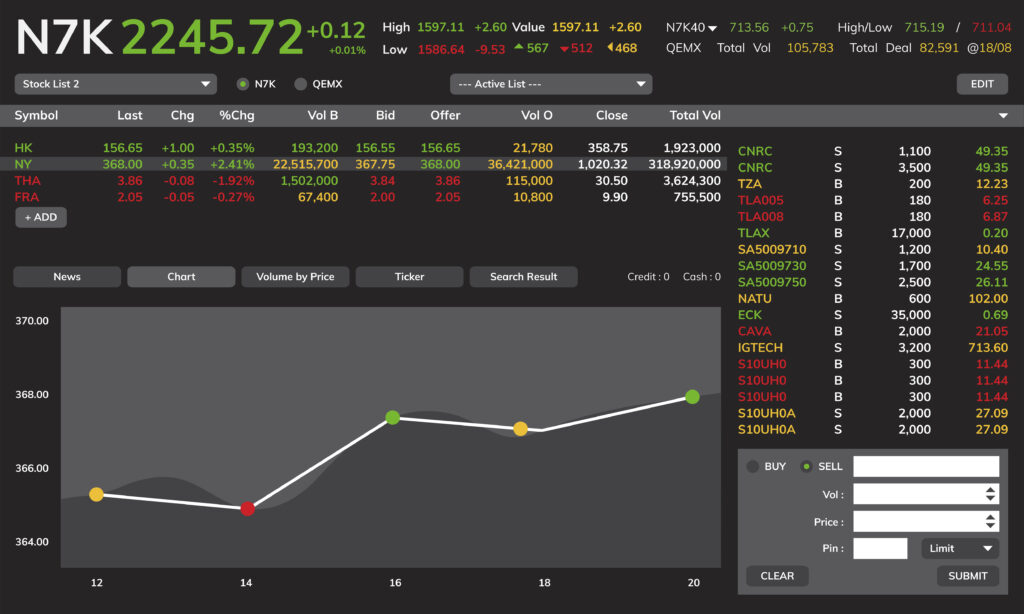

According to analysis tools:

While there is limited detailed reporting on SEC scrutiny or delisting threats in recent months, investor sentiment has clearly been shaken by:

Despite challenges, MSP Recovery has pursued strategies to regain credibility:

| Category | Insight |

| Price Performance | Steep long term decline –90%+ high volatility sharp short term swings |

| Financial Health | Low revenues high losses weak margins and liquidity |

| Investor Sentiment | Skepticism remains attempts at recovery via announcements |

| Regulatory / Risks | No recent SEC delisting filings found but penny stock nature is risky |

This is not financial advice but here are some points to consider before investing:

Maryland Supreme Court Win: On July 15 2025 MSP Recovery secured a pivotal legal victory with the Maryland Supreme Court affirming the company’s right to assign claims this success lays the foundation for broader litigation such as the class action lawsuit against GEICO.

investor.lifewallet.com Active Settlement Pipeline: Beyond litigation the company lately achieved a $2 million pharmaceutical litigation settlement and is negotiating with various insurers and manufacturers. GlobeNewswireYahoo Finance

Securing more wins like these or converting existing claims to cash would boost both revenue and investor trust.

If these partnerships deliver actionable data and fast processing, they can significantly underpin growth and credibility.

These steps suggest a sharper focus on financial stability and long-term planning crucial for restoring confidence.

Continued adherence to SEC and Nasdaq standards will be essential to avoid delisting risks and maintain investor credibility.

| Catalyst | Why It Matters |

| Legal victories & settlements | Fuel short-term cash flow and investor confidence |

| Rich data partnerships | Deliver scalable pipeline of claim recoveries and operational leverage |

| Unified brand & debt relief | Clearer identity and improved financial flexibility |

| Regulatory compliance | Ensures continuous Nasdaq listing and investor trust |

LIFW is the stock ticker for MSP Recovery, Inc. also known as LifeWallet listed on the NASDAQ.

LIFW stock is highly speculative. It may offer upside for aggressive investors but carries substantial risk.

Due to low trading volume legal uncertainty and inconsistent revenue reports LIFW stock experiences extreme price swings.

The company identifies and reclaims mispaid Medicare and Medicaid claims using AI-driven data analysis and legal action.

No, LIFW does not offer any dividends. Its revenue is reinvested into operations and legal proceedings.

Most experts consider it a short term speculative trade but long term bullish investors are banking on successful legal recoveries.

Yes. The company has faced SEC scrutiny over financial disclosures and other public reporting concerns.

You can buy LIFW through any brokerage that supports NASDAQ listed stocks such as Robinhood E*TRADE or Fidelity.

LIFW stock represents a bold and unconventional investment opportunity. Its unique legal + data recovery model is intriguing but the risks are just as real. If you are looking to diversify into disruptive healthcare plays LIFW might deserve a spot on your watchlist just make sure to do your own due diligence.